Compound interest is often compared to a snowball that grows over time. Much like a snowball at the top of a hill, compound interest grows your balances a small amount at first. Like the snowball rolling down the hill, as your wealth grows, it picks up momentum growing by a larger amount each period. The longer the amount of time, or the steeper the hill, the larger the snowball or sum of money will grow. You may, for example, want to include regular deposits whilst also withdrawing a percentage for taxation reporting purposes.

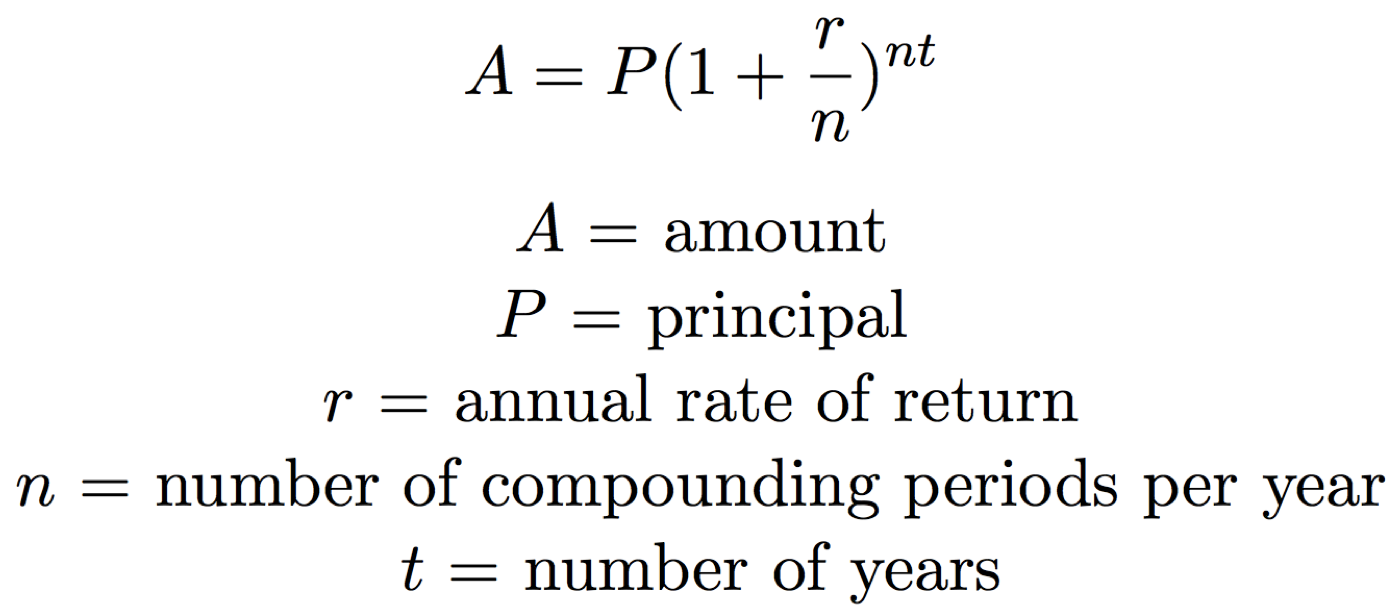

Compound Interest Formula (simple)

Periodic payments that occur at the end have one less interest period total per contribution. This formula is the projected rate of return on an asset or investment, even if it does not explicitly pay compounded interest. The CAGR is a form of the compound interest formula, but rearranged algebraically to solve for the interest rate using the beginning balance, ending balance and number of periods.

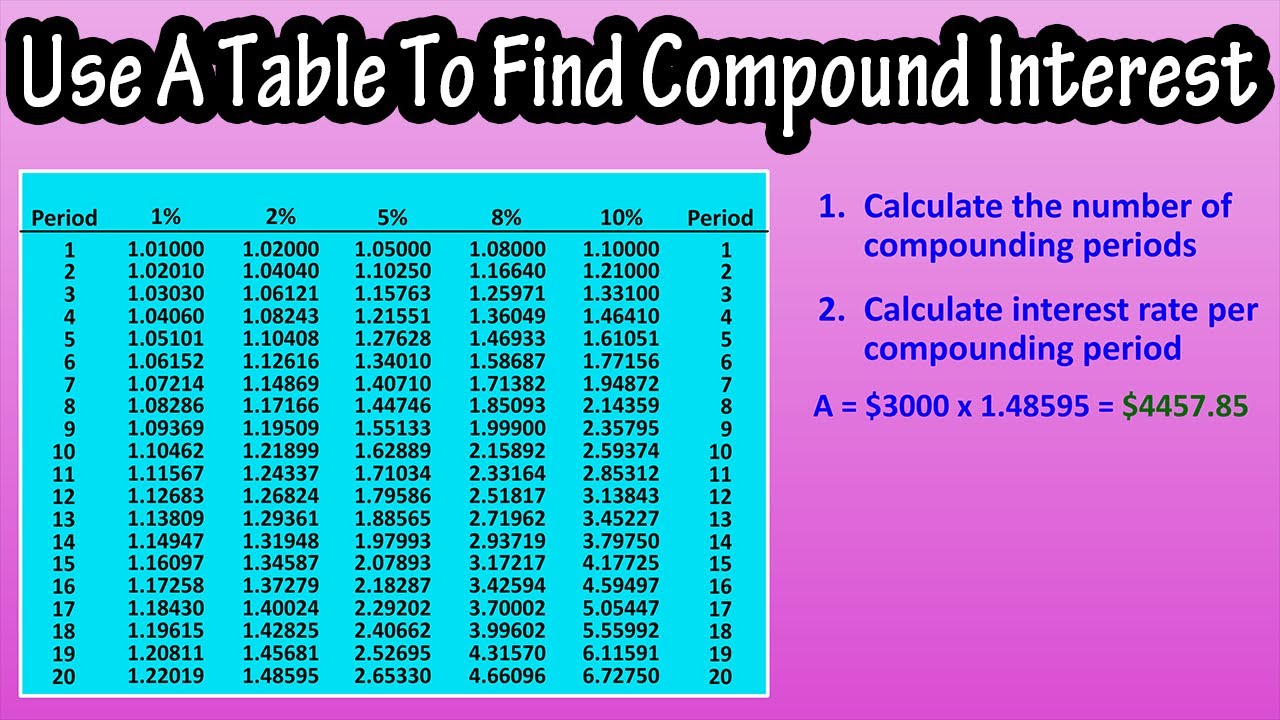

Sample Compounded Interest Calculations

For our Interest Calculator, leave the inflation rate at 0 for quick, generalized results. But for real and accurate numbers, it is possible to input figures in order to account for inflation. The longer you take to pay off your debts, the higher your compounding interest will be, and you’ll end up paying back much more in the end. You could get rid of them now, but instead, you wait a few days to take care of them. If you had taken care of the bed bugs right away, they wouldn’t have been able to multiply at such a rate. Calculate percentage additions and deductions with our handy calculator.

- In this case, our total accumulated interest is $216.65 (once again, this is the sum of interest earned each year).

- So, while we contributed $1,500 ($500 per year for 3 years), the balance increased by $1,576.25 since we earned interest for 2 years on the first contribution and for 1 year on the second contribution.

- The compounding frequency, which is the time period at which interest is added to the principal, can have a slight positive effect on the effective interest rate versus the nominal annual interest rate.

- For example, in a six-month simple interest GIC the balance in its account at any point before the maturity date is the original principal and nothing more.

Simple Interest

Therefore, the fundamental characteristic of compound interest is that interest itself earns interest. This concept of adding a carrying charge makes a deposit or loan grow at a faster rate. Visit InterestMagician.com for interactive compound interest calculations.

Simple interest refers only to interest earned on the principal balance; interest earned on interest is not taken into account. To see how compound interest differs from simple interest, use our simple interest vs compound interest calculator. Just enter your beginning balance, the regular deposit amount at any solve your irs tax problems bbb ‘a+’ rated tax debt relief specified interval, the interest rate, compounding interval, and the number of years you expect to allow your investment to grow. Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all the accumulated interest of previous periods of a deposit.

Compound Interest Formula (with regular deposits)

Once again, our formula calculates a future value, but we are only one step away from calculating interest. In our example, the accumulated interest is $218.99, which is our future value of $1,218.99 minus our principal of $1,000 (remember that this interest is the sum of all the interest payments each year). Compounding can help fulfill long-term savings and investment goals, especially if you have time to let it work its magic over years or decades.

Due to the way the compound interest formula works, the more frequently you compound, the more interest earned (or charged). Use a daily compound interest calculator to better determine your day-to-day rates. Let’s say you invest $1,000 in an account that pays 4% interest compounded annually. In order to calculate the future value of our $1,000, we must add interest to our present value. Because we are compounding interest, we must reinvest our interest earned so that our interest earned also earns interest.

For standard calculations, six digits after the decimal point should be enough. Read on to learn more about the magic of compound interest and how it’s calculated. You can also calculate compound interest using our interest calculator, which allows you to calculate either simple or compound interest. The Rule of 72 is just an approximation, to find the exact time to double you can use our Rule of 72 calculator. So, while we contributed $1,500 ($500 per year for 3 years), the balance increased by $1,576.25 since we earned interest for 2 years on the first contribution and for 1 year on the second contribution. This formula works best for interest rates between 6 and 10%, but it should also work reasonably well for anything below 20%.

Should you need any help with checking your calculations, please make use of our regular interest compoundingcalculator and daily compounding calculator. As a final note, many of the features in my compound interest calculator have come as a result of user feedback. So, if you have any comments or suggestions, I would love to hear from you. This compounding effect causes investments to grow faster over time, much like a snowball gaining size as it rolls downhill. When the returns you earn are invested in the market, those returns compound over time in the same way that interest compounds. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating.