Gross margin on the other hand focuses on the organisation’s trading activities. Once again, in simple terms, the higher the better, with poor performance often being explained by prices being too low or cost of sales being too high. For example, if you are told that a business has an Operating profit margin of 5% and an asset turnover of 2, then its ROCE will be 10% (5% x 2). It means that any what is target profit and how is it calculated change in ROCE can be explained by either a change in Operating profit margin, or a change in asset turnover, or both. We now have all the required inputs to forecast our accounts payable line item, which we’ll accomplish using the following formula. A high DPO can indicate a company that is using capital resourcefully but it can also show that the company is struggling to pay its creditors.

Is it better to have a high or low DPO?

However, the benefit of the early collection is that amount can be utilized in the business. You do need to take some care when analyzing the firm’s average payable period as the balance needs to be right. Ensuring timely collections enables timely payments, creating a positive cycle of financial efficiency. However, if the DSO were to increase significantly, it could indicate that the retail business is facing delays in receiving payments, potentially leading to cashflow challenges. This article will guide you on how to figure out DPO, including the calculation formula and how it reflects your business payment practices.

average payment period

It follows cash through inventory and accounts payable, then into expenses for product or service development, to sales and accounts receivable, and then back into cash in hand. The APP ratio of a company can provide important information about its overall financial operations. The APP displays the typical time businesses take to use revenues for covering these types of costs. Incoming cash flow that businesses generate is advantageous for funding investments, paying down liabilities, and covering operational expenses.

Everything You Need To Master Financial Modeling

The management team will use this information to determine if paying off credit balances faster and receiving discounts might produce better results for the company. The cash conversion cycle (CCC), also called the net operating cycle or cash cycle, considers how much time the company needs to sell its inventory, collect receivables, and pay its bills. While abstract principles provide a solid foundation of understanding, real-world case studies often serve as the best teachers. These transparent, practical examples can offer vital insights into the impact of the average payment period on a company’s overall financial health and success. Although 48% of customers delay payments, well-structured payment terms can motivate them to clear their dues on time.

- While the supplier or vendor delivered the purchased good or service, the company placed the order using credit as the form of payment (and the related invoice has not yet been processed in cash).

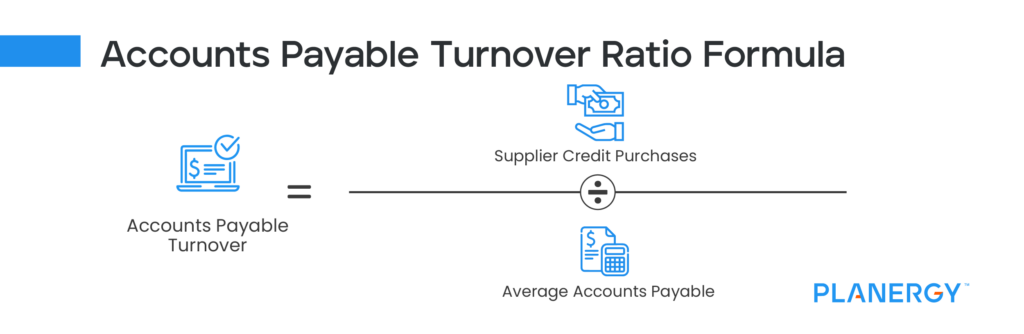

- The equation to compute the average accounts payable of a company is as follows.

- To analysts and investors, making timely payments is important but not necessarily at the fastest rate possible.

We’ll also explore how modern software solutions can optimize this process for businesses. Accounts payable are short-term debt that a company owes to its suppliers and creditors. The accounts payable turnover ratio shows how efficient a company is at paying its suppliers and short-term debts. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payable turnover shows how many times a company pays off its accounts payable during a period. The ratio shows how many times in a given period (typically 1 year) a company pays its average accounts payable.

A lower value indicates that the company can collect capital in a short time, enhancing its cash position. Accounts receivable is a business term used to describe money that entities owe to a company when they purchase goods and/or services. AR is listed on corporations’ balance sheets as current assets and measures their liquidity. As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows.

By similar logic, if we wished to calculate return on ordinary shareholders funds, we would use profit after interest and tax divided by total equity. Also, keeping track of AP benchmarks helps determine how well your AP department functions, cash flow, and overall supplier satisfaction. With AP automation, teams can collaborate anytime and from any location to make important decisions that support continued production and improve brand reputation. This proactive approach in managing accounts payable, facilitated by advanced software solutions, is key to avoiding late payments, interrupted production, and potential brand damage.

The average collection period may also be used to compare one company with its competitors, either individually or grouped together. Similar companies should produce similar financial metrics, so the average collection period can be used as a benchmark against another company’s performance. Alternatively and more commonly, the average collection period is denoted as the number of days of a period divided by the receivables turnover ratio.

Suppliers may even offer discounts or favorable terms to businesses that demonstrate a consistent pattern of short APPs. Collecting its receivables in a relatively short and reasonable period of time gives the company time to pay off its obligations. The best way that a company can benefit is by consistently calculating its average collection period and using it over time to search for trends within its own business.

It is very important for companies that heavily rely on their receivables when it comes to their cash flows. Businesses must manage their average collection period if they want to have enough cash on hand to fulfill their financial obligations. Average collection period is calculated by dividing a company’s average accounts receivable balance by its net credit sales for a specific period, then multiplying the quotient by 365 days. The average payment period only demonstrates data calculations and excludes any qualitative elements that might influence a company’s credit coverage.

Return on capital employed (sometimes known as return on investment or ROI) measures the return that is being earned on the capital invested in the business. Candidates are sometimes confused about which profit and capital figures to use. This represents the profit available to pay interest to debt investors and dividends to shareholders. It is therefore compared with the long-term debt and equity capital invested in the business. Capital employed can be calculated as (non-current liabilities + total equity) or (total assets – current liabilities).